On an absolute remuneration basis, as disclosed, FirstRand group us president Johan Burger could be the best-paid among CEOs of South Africa’s five largest banks. Investec is deliberately excluded from that comparison as remuneration is pounds, which skews it dramatically (after conversion). In 2016, the six CEOs (given Standard Bank’s joint CEO structure) were paid R163.4 million in guaranteed remuneration and short-term bonuses (generally paid in cash and shares).

|

Chief executive |

Bank |

Total remuneration |

|

Johan Burger |

FirstRand |

R33.947 million |

|

Sim Tshabalala |

Standard Bank |

R32.078 million |

|

Ben Kruger |

Standard Bank |

R31.985 million |

|

Maria Ramos |

Barclays Africa Group |

R29.509 million* |

|

Mike Brown |

Nedbank |

R22.281 million |

|

Gerrie Fourie |

Capitec |

R13.580 million |

However, it should be noted that Maria Ramos have also been given restricted share awards (in conjunction with 73 other Barclays Africa executives) to “retain skills necessary to the Barclays Plc sell-down and beyond” (read more: Barclays Africa splashes R191m to retain execs in sell-down). That is valued at R8 million and is also excluded through the total remuneration for your year disclosed inside group’s annual report and it’s specifically separate from other long-term incentives. This R8 million should arguably be included to Ramos’s total remuneration for 2016, in which case she would handily top the table at R37.509 million.

Remuneration packages because of these executives comprised:

- Guaranteed package = Cash package + Retirement contributions + Other allowances

- Short-Term Incentive (STI) = Cash bonus + portion in shares (deferred you aren’t)

- Long-Term Incentive (LTI) = Shares awarded as part of various incentive plans

The third item for this list is excluded within the table above as even though this is remuneration ‘paid’ during 2016, its future value is not possible to calculate. Some banks disclose the latest face value of LTIs awarded, however isn’t everything useful as the vest eventually and will typically be exercised at varying strike prices. In addition ,, you’ll find all manner of hurdles around matching rates which complicate things further.

|

Chief executive |

Bank |

Guaranteed package |

|

Maria Ramos |

Barclays Africa Group |

R14.509 million |

|

Gerrie Fourie |

Capitec |

R9.830 million |

|

Johan Burger |

FirstRand |

R9.617 million |

|

Sim Tshabalala |

Standard Bank |

R9.198 million |

|

Ben Kruger |

Standard Bank |

R9.105 million |

|

Mike Brown |

Nedbank |

R7.781 million |

From the guaranteed package standpoint, Barclays Africa’s Maria Ramos pays 50% much more than the next best-paid CEO (Capitec’s Gerrie Fourie). Interestingly, remuneration with this foundation for three on the five banks is clustered across the R9 million to R10 million range. Ramos is paid a share of her package (R6.5 million) by means of ‘role-based pay’ which Barclays Africa describes as being a “unique element shown ensure that the remuneration your executive directors, prescribed officers and material risk takers remains commensurate with market pay levels as a result of impact of European regulations”. The invoices it “will be phased out after the Barclays Plc sell-down is complete and also the new long-term incentive programme actually vest”. Ramos’s role-based pay for 2016 was split 50:50 in phantom shares and cash. The phantom share restrictions lift over a few years (20% per annum), while using approach taken by former parent Barclays Plc.

FirstRand chairman Laurie Dippenaar took the unusual step of devoting two pages from the group’s 2016 integrated report to “additional commentary on remuneration”. He writes: “I don many occasions in my statement attemptedto explain in simple terms why My business is more comfortable with our remuneration philosophy. The rigorous health checks we apply are demonstrated below and, in my opinion, have already been consistently applied in the past and get directly driven the outperformance our shareholders have enjoyed. The board is incredibly cognisant within the degrees of scrutiny required on compensation and then we believe our frameworks hold up against scrutiny.”

Burger tops the charts over the variable piece of remuneration, which has a total of R24.33 million in 2016 (comprising a R13.165 million cash bonus and R11.165 million deferred in share awards).

|

Chief executive |

Bank |

Variable remuneration |

|

Johan Burger |

FirstRand |

R24.33 million |

|

Ben Kruger |

Standard Bank |

R19.269 million |

|

Sim Tshabalala |

Standard Bank |

R16.1 million |

|

Maria Ramos |

Barclays Africa Group |

R15 million |

|

Mike Brown |

Nedbank |

R14.5 million |

|

Gerrie Fourie |

Capitec |

R3.75 million |

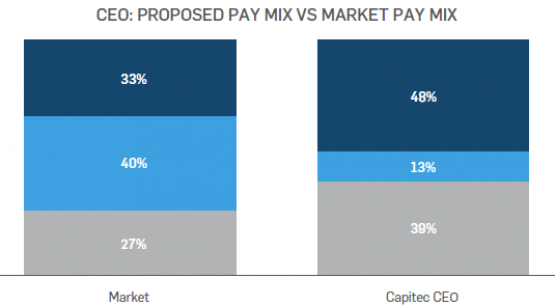

Capitec’s CEO was paid the bonus (R3.75 million), based on its remuneration policy. It describes its short-term incentive earning potential as “conservative for the market, supporting Capitec’s key remuneration principle of long-term alignment with shareholders”.

Source: Capitec 2017 integrated report

Another technique of looking at remuneration, arguably, would be to calculate a great total for that year, i.e. pay as disclosed above not to mention property value shares vested and taken up in the past year. This is disclosed separately by companies (sometimes as the note towards the fiscal reports).

|

Chief executive |

Bank |

Remuneration |

Value of shares vested, exercised in the year |

Total |

|

Gerrie Fourie |

Capitec |

R13.580m |

R98.860m |

R112.440m |

|

Johan Burger |

FirstRand |

R33.947m |

R28.504m |

R62.451m |

|

Maria Ramos |

Barclays Africa Group |

R29.509m |

R27.238m |

R56.747m |

|

Ben Kruger |

Standard Bank |

R31.985m |

R20.335m |

R52.320m |

|

Sim Tshabalala |

Standard Bank |

R32.078m |

R10.701m |

R42.779m |

|

Mike Brown |

Nedbank |

R22.281m |

R16.911m |

R39.192m |

Banks will surely reason that it’s not linked with just how much ‘earned’ in the past year since several shares which vested and were exercised during 2016 were as part of long-term incentives awarded in years past (sometimes a decade or more). But, this calculation is designed with a have a look at the amount of money actually ‘taken home’ by CEOs during the year.

Because of Capitec’s remuneration policy (with dramatically smaller short-term incentives/bonuses and far larger long-term incentives (through share options and share appreciation rights), it is no surprise that Fourie tops this table. It noted he has just been CEO since 2014. In accordance with the share price as at February 28, Fourie features a total of nearly R300 million (R295.2million) in unvested and unexercised instruments.

Listen:?Bank CEO pay: What’s fair in a unequal society?

Barclays Africa’s Ramos had 239 670 shares under award as at December 31, Standard Bank’s Tshabalala had 1 432 502 shares, Kruger 935 803, Nedbank’s Brown 239 016, while FirstRand’s Burger had 1 424 288 shares outstanding as at June 31 2016.

* Hilton Tarrant works at immedia. He could nevertheless be contacted at hilton@moneyweb.co.za.

* He owns shares in FirstRand, first bought in July 2011.

* FirstRand’s 2016 financial year ran to June 30 2016.

* Capitec’s 2017 financial year ran to February 28 2017.

* Standard Bank, Barclays Africa Group and Nedbank’s financial years ran to December 31 2016.

Oops! We can easily not locate your form.