Foreign investors are already snapping up South African banking stocks, enticed by way of the cheapest valuations relative to emerging-market peers since 2011, even while the nation’s downgrade to junk deepened a vast equity selloff.

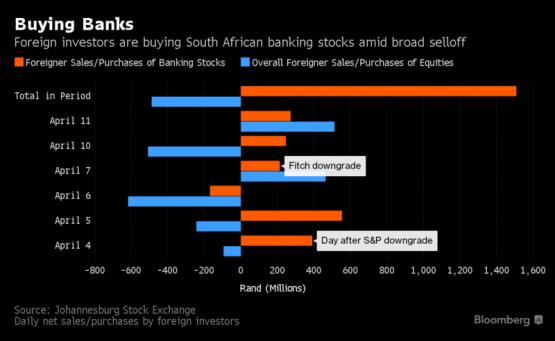

Offshore investors got such a net R1.5 billion ($109 million) of bank shares, including your FirstRand and Barclays Africa Group, while in the six days after S&P Global Ratings downgraded the South Africa’s fx debt on April 3. Fitch Ratings followed by using a similar cut on April 7, described by a banking industry body as ” devastating” for lenders. Excluding bank shares, foreigners sold a web R2 billion of other stocks from the same period, bringing equity outflows in 2010 to R43.8 billion, in accordance with JSE data.?

Valuations in the country’s banks have plunged to Ten times historical earnings, balanced with 19 with the benchmark FTSE/JSE All Share Index. While facing higher costs of capital, rising money owed in addition to a slowdown in lending, banks are incredibly capitalised to resist the storm and economical enough for being bargains, said Adrian Cloete, an analyst at PSG Wealth in Cape Town.

“Banking shares are seeking interesting coming from a valuation perspective,” Cloete said by email. “The current almost-50% discount is very large when compared to long-term trading history” as well as lenders will provide “very attractive dividend yields,” he said.

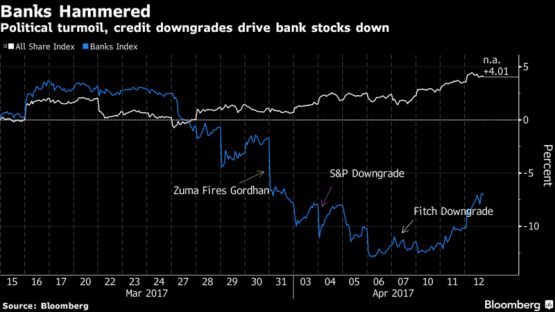

South Africa’s four biggest banks were profitable with the global financial trouble of 2008 as well as the country’s recession each year later. When using the lenders better capitalised now than they were then, surveys compiled by Bloomberg show analysts expect those to remain profitable rapidly downgrades and President Jacob Zuma’s firing of Finance Minister Pravin Gordhan in March.

Banks happen to be finding your way through the downgrades, and even Gordhan’s removal, since Zuma roiled markets when he fired former Finance Minister Nhlanhla Nene in December 2015, said Neelash Hansjee, banks analyst at Old Mutual in Cape Town.

Still, Africa remains liable to further downgrades along with the political situation is much from stable. Opposition parties marched on Wednesday to for Zuma’s ouster, and Parliament may debate a motion of no confidence in the president pending?in conclusion of the application on the country’s top court seeking a secret ballot.

In the occasions after S&P’s rating downgrade the rand, which had been our planet’s best-performing currency in 2017, threw in the towel the year’s gains while bond yields spiked, enhancing the banks’ cost of capital. Actually committing to banks right this moment may be risky, though cheap.

Not all investors are of the opinion. Policy uncertainty will keep to weigh on South African assets, said John Ashbourne, an London-based economist for Africa at Capital Economics Ltd. The ruling African National Congress is holding an insurance policy conference in June after Zuma promised “radical economic transformation” following Gordhan’s dismissal.

“I can’t locate any silver lining for the nation’s banks,”?Ashbourne said. “We’re waiting around for the insurance policy conference in June for the warning signs of modifications to the nation’s tax and spending policy. Before that takes place, there’s a lot of uncertainty.”

The hardest hit bank share this holiday season is Barclays Africa, containing to contend besides with strife to use real estate arena, but its parent company’s planned sale of stock. The six-member banks index has slumped 6.3% considering that the first downgrade, in comparison to a 3.1% gain in the 164-member All Share Index. Your budget gauge would be the worst-performing index in South Africa this coming year and also by eliminate March had suffered its poorest first quarter in eight years.

That shouldn’t deter bargain hunters, PSG’s Cloete said.

“The point is that South African banks’ balance sheets and capital ratios are really healthy, that would be very comforting to investors,” he said. “They are certainly profitable wealthy in returns on equity.”

? 2017 Bloomberg