The rand’s for a tipping point, with analysts and derivatives traders at odds across the next move for South Africa’s currency.

For Societe Generale SA, the rand’s 7.3% rally up to now 3 weeks is merely a temporary blip, with an increase of weakness waiting as poor fundamentals and a unfavourable external backdrop weigh around the currency. Others, including Standard Chartered, observe the currency as undervalued and due for more gains, though perhaps just about yet.

“The rand falls in a class of currencies we’re looking closely at but employ a great deal of challenges,” Eric Robertsen, global head of foreign-exchange research at Standard Chartered, told reporters in Johannesburg. “Our expectation is that the currency will improve. Nevertheless it’s wanting a catalyst.”

That catalyst may be found immediately, by using a raft of knowledge that could give clues about the outlook for South Africa’s economy including jobs numbers, the trade balance and producer inflation, along with the Federal Reserve’s rates decision Wednesday.

These charts show just how the finance industry is positioned ahead of those events:

Analysts’ forecasts

Analysts are getting more bearish, with the median forecast with the rand in comparison to the dollar by year-end climbing to 14.75, from 13.80 soon after August. That could represent a weakening of about 3% by reviewing the current volume of 14.36.

“The risk backdrop for emerging markets remains fraught by challenges along with the ongoing drain of global liquidity, slowing global growth, and trade tensions,” strategists at Societe Generale including Jason Daw said in a report. “The rand is very vulnerable because current-account deficit, high foreign participation in local financial markets, low foreign-exchange reserves and weak debt and fiscal metrics.”

Futures gloom

Traders in the futures markets are bracing to get more detailed declines, with CFTC data showing net short-rand positioning for the highest since December 2015. The bearish views on the currency come well before a rating decision by Moody’s Investors Service and South Africa’s mid-term budget statement, both due later.

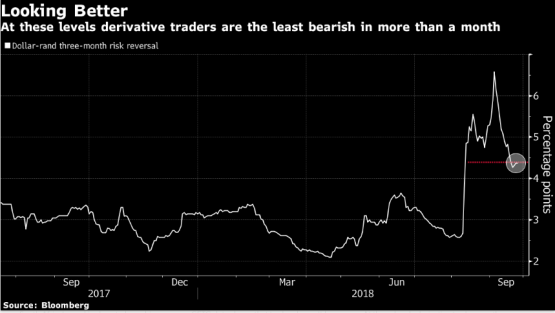

Options outlook

But the specifications markets is less gloomy, with bearish rand bets easing through the two-year-high levels reached on September 5. The premium of options to sell the currency over the crooks to buy it over the next 90 days, termed as a 25-Delta risk reversal, has declined 223 basis points ever since to a one-month low, and by this measure traders are less pessimistic concerning the rand than the Russian ruble and Turkey’s lira.

Building momentum

The rand is close to strengthening below its 50-day moving average against the dollar, suggesting momentum is swinging in the rand’s favour. The very last which it fell below that measure using a sustained basis, in November during the past year, the rand strengthened about 13% contrary to the dollar in 4 months.

? 2018 Bloomberg L.P