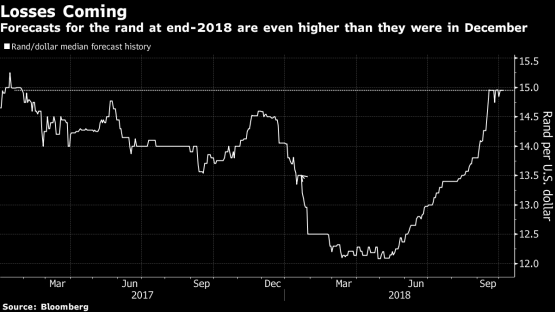

There’s no room left to run for South African investors who would like to diversify away from the country’s ailing economy — and the could be nice thing about it for your rand, based on the top forecaster in the currency from the dollar.

South Africa increased limits for the amounts institutions may invest offshore by 5 percentage points in February, to 40% for fund managers and 30% for pension funds. Most investors are at or all-around those levels, providing crucial support for your rand at any given time when emerging-market assets are under pressure from rising US rates, in accordance with Mike Keenan, a Johannesburg-based strategist at Absa Group.

“That will cap the rand weakness,” said Keenan, who predicts the currency can certainly all seasons a couple of.5% stronger at 14.25 per dollar. Absa was probably the most accurate forecaster within the rand compared to the dollar within the third quarter, based on data published by Bloomberg.

The rand has slumped 19% forever of April amid an emerging-market sell-off sparked by rising US rates and a stronger dollar, and fuelled by crises from Turkey to Argentina. South Africa’s economy sank to a recession during the first half, raising concern that tax revenue will lag government forecasts and strain fiscal targets. Political uncertainty surrounding land reform and mining rules also unnerved some investors.

“Our view also accounts for South Africa’s weak growth backdrop additionally, the inflation cycle, and also challenging global environment,” Keenan said. Other risks to his forecast are rising US rates along with an escalation while in the US-China trade war, with South Africa’s reliance upon commodity exports allowing it to be particularly at the mercy of a slowdown in global growth, he stated.

The rand edged 0.1% weaker on Thursday to 14.66 per dollar, extending Wednesday’s 2% slump that had been sparked with the start US Treasury yields for the highest level since 2011. With foreign investors holding about 40% of government bonds, after dumping R55.7 billion in the debt this year, Africa is susceptible to capital flight as higher US rates attract money for the dollar.

The odds around the rand reaching Keenan’s target of 14.25 by year-end are 73%, based on Bloomberg calculations according to the expense of options to buy and sell the currency.

? 2018 Bloomberg L.P