South Africa’s rand is one of emerging-market currencies most at risk from upheaval if Britain votes to go out of european union, while ruble investors should find some enjoy the isolation made available from sanctions on Russia.

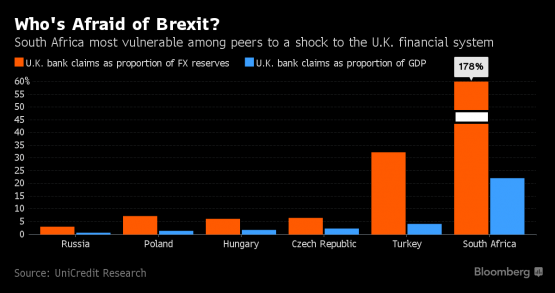

That’s a feasible conclusion to draw in with a ranking of nations in central Europe and Africa in accordance with the depth of the financial ties with UK banks,?published by analysts at UniCredit. British lenders’ claims on entities in Africa add up to 178% from the country’s foreign-currency reserves. For Russia, with already-weak links to Britain curbed further by US and European restrictions since 2014, the exposure is 3%.

This will matter if your British public vote to exit the 28-member bloc within a referendum on June 23, potentially unleashing a bout of monetary volatility that economists predict may send the pound tumbling to some 30-year low. UK.banks may shore up defences by bringing in debts and holding back new lending. In Nigeria, addiction to funding from Britain’s banks exceeds foreign-currency reserves, limiting the central bank’s capability to defend the rand.

“If you will find a shock and whatever has been lent in the UK to those countries were to be returned, that might bring about capital outflow and currency weakness,” said? Kiran Kowshik, a London-based emerging-markets strategist at UniCredit. Kowshik said he considers a vote to be within the EU to be the most likely outcome though the analysis of monetary exposure partly influenced a so-called long recommendation for the ruble compared to the rand. ?

The UniCredit analysis uses data with the Bank for International Settlements tracking liabilities and assets of banks within economies.

The rand rose 0.2% about the dollar plus the ruble climbed 0.5% by 11:35am working in london on Wednesday.

Emerging-market investors, who definitely have previously been more complacent around the referendum than their developing-world peers, have started to evaluate the danger of the so-called Brexit for the reason that voting date nears and also the latest opinion polls signal the campaign to go out of is pulling ahead.?Amundi Asset Management said this month there is reduced exposure to debt in central Europe, partly over threats to funding with the region from the potential exit of the third-biggest net contributor to the EU budget in 2014.

Another way an english exit could impact emerging-market economies is thru disruptions to trade.?The british isles is Turkey’s second-largest and Poland’s third-most important export market, shipping greater than $10 billion from each in 2015. Britain was the fourth-biggest destination for South Africa’s exports not too long ago, amounting to $5.8 billion, reported by data created by Bloomberg.

The effect of trade might not be so large even when a leave vote creates a recession in great britan, in accordance with analysts at Capital Economics inside london. The impact will be spread across several countries with limited affect on every, the trainer told us. A UK exit could potentially cause some disruption to global capital flows as investors pull funds from riskier assets, at the least for a while, the analysts, including Neil Shearing, said a voice-mail published on June 10.?

South Africa and Turkey have current-account shortfalls in excess of 4% of national output, leaving them more susceptible to adjustments in investor sentiment since they be based upon foreign funding to pay for the deficit, data composed by Bloomberg show.

“Brexit will cause a knee-jerk selloff in risk,” said Kevin Daly, a money manager at Aberdeen Asset Management in London, which oversees $11 billion of emerging-market debt. “It’s a hardship on us as emerging-market managers to remain positioned for Brexit since you can’t really hide.”

? 2016 Bloomberg