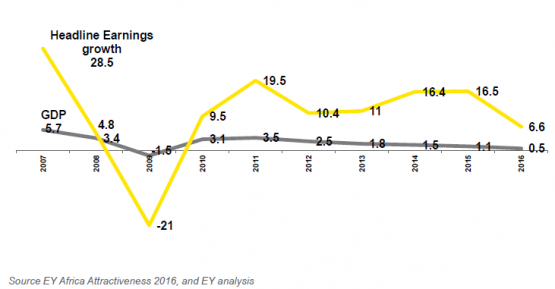

Growth in cumulative headline earnings by South African banks fell to a seven-year low through the 2016 365 days.

An analysis by EY shows total headline earnings via the six major banks – Barclays Africa, Capitec, FirstRand, Investec, Nedbank and Standard Bank – grew by 6.6% to R80 billion balanced with an improvement rate of 16.5% to R70 billion in 2015.

“We’re seeing a host where banks are expanding their lending, pricing in take more chances appropriately but still lending profitably but on a lower rate of growth than before,” said Andy Bates, Financial Services Africa Leader at EY. ?

Bank earnings boost affect on GDP growth

Source: EY South Africa Banking Results 2016

Based when using annual economic growth estimate of 0.6%, the firm saw that South African banks earnings were 11x greater than estimated GDP growth. New data from Statistics Africa, released after EY presented its findings, reveals that the economy grew by 0.3% in 2016, down from 1.3% previously. Reported by EY, each 1% increase in GDP results a 5% boost in headline earnings.

Among the factors that weighed on domestic banks in 2016 were multi-year low growth rates in one payemnt advances and assets. Asset growth through the bank’s rest of Africa operations turned negative the very first time in over 19 years, falling by 10.8% to R265 million.

Balance sheet highlights

Source: EY South African Banking Results 2016

Bates said the decline in asset growth attributable operations over the continent is not really surprising as African lending contracted in 2016, particularly caused by experience Nigeria and Kenya.

The banks which presented financial most current listings for the time ending December 31 2017, said the effects of Nigeria’s shrinking oil-based economy and the devaluation of your Nigerian naira and also rate of interest caps in Kenya weighed for their African operations.

In spite of slow advances, total revenue increased by 9% to R285 billion. Net interest income rose 15% to R145 billion while non-interest revenue increased 2.5% to R143 billion. Bates said the stable benchmark interest rate of 7% saw banks are more cautious with lending whilst providing the opportunity to generate higher returns, particularly compared with peers in great britain (UK) which might be operating from a record-low interest rate environment.

Overall return on equity of 16.8%, down from 18.5%, remains strong when compared to banks in great britain and various emerging markets, he explained. A 1% rise in the expense of equity to 14.4% is partly to blame for the decline in returns. ?

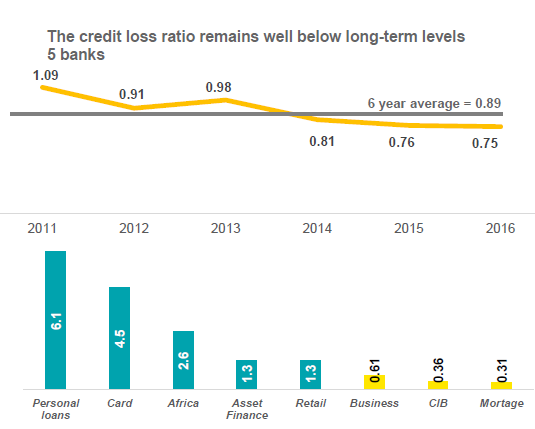

The credit loss ratio of 0.75% was relatively unchanged through the 0.76% calculated last year.

Impairments

Source: EY South African Banking Results 2016

Bates said the stable credit loss ratio masks the reality that financial institutions remain come across delinquency through their unsecured lending books comprising unsecured loans, cards, asset finance and retail.

“The stable level ensures that banks were more judicious with the way that they lend and still have been focused on secured lending through corporate and investment banking and business banking,” he added.

Operating expenditure ?

Source: EY South African Banking Results 2016

EY said operating expenses were in line with revenue growth, with boost in IT spending outpacing all but depreciation and amortisation. ?

Listen to?Andy Bates when he discusses laptop computer on SAfm with Siki Mgabadeli?here.

Oops! We could not locate your form.