S&P Global Ratings looks after a negative outlook on South Africa’s rated banks at the outset of 2017 but sees the pressures on domestic banks easing.

In its latest Ratings Direct report, S&P attributed the negative sentiment to your mix of weak economic growth and also the persistent credit chance over-leveraged households.

However, a modest improvement in real GDP growth including a slower monthly interest rate hikes, if any, is required to supply some support.

“We expect pricey risks will keep to lie dormant to the domestic banking sector and so credit losses to the top tier banks of between 0.8% and 1.0% in 2017.

“We expect the domestic banking sector’s return on equity to stabilise at 15%-19% for one more year or so since the positive effect of the gradual rise in home interest rates is mitigated by increasing provisions and price of funds,” said S&P.

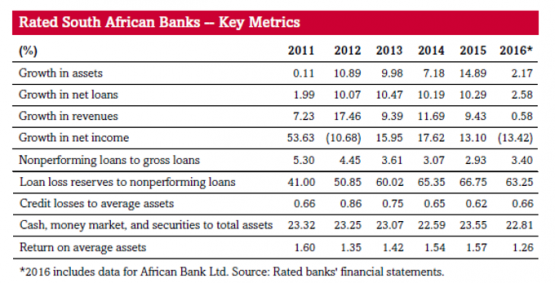

Source: S&P Global Ratings, February 2017

The ratings agency cut its domestic growth assumptions to 0.5% for 2016 and 1.4% for 2017, down in the 0.6% and 1.7% forecast for a similar period in June during the past year. It said South Africa’s growth is contingent on global growth, especially as being the economy is directly and indirectly related to commodities demand from China.

“Long-term domestic challenges remain a persistent continue growth, although the us govenment has identified important reforms and provides bottlenecks, you will need a very long time to treat the longstanding skills shortage and infrastructure bottlenecks. Without warning signs of real improvement or at a minimum policy certainty and continuity, private sector investment is likely to remain low,” S&P said.

It flagged domestic households as the most vital risk source for banks this can relatively high leverage and wide income disparities as compared to other emerging markets.

Household debt to disposable income fell to 77.6% in 2015 from 85% in 2008. But S&P is worried in regards to the changing nature on the leverage from secured residential mortgages to unsecured lending and instalment credit.

It said weakening household affordability, indicated by a rise the debt-service-to-disposable income to 9.3% in 2015 (up from 8.7% in 2012), is affected by rates of interest and affordability.

“We think that the impetus for rate increases is declining, balancing the cheaper economic growth and inflation outside the publicised array of the central bank. Exogenous shocks could change this, especially if the US dollar apr normalisation occurs quicker and harder than supermarket expect. However, our base case now anticipates interest rates rises of 25-75 basis points on the next 12-18 months and inflation of 6%-7%, that can go on to pressurise household affordability but is not materially weaken asset quality,” it said.

According to S&P, the banks’ corporate loan books will be to outperform loans to households in 2017. A less than 3% total loan expertise of mining and minimal foreign currency all over the entire book, protects human eye loans against resources in addition to a weak rand.

It also expects the restructuring of funding profiles, spurred by way of a have to meet Basel III liquidity coverage ratios and net stable funding ratios, to slow or stop partly due to regulatory discretion.?

“With regard to systemic shock, we come across the closed rand system and lack of external and difficult currency funding as the significant boon with the South African banks, especially balanced with other emerging markets, which can be important given reduced global liquidity and anti-emerging market investor sentiment,” it said.

S&P added that this divestments and partial unbundling of your South African banking group most likely to have an affect their performance in the next year. Instead, the banks’ operations in the most Africa will probably weigh on profitability.