There’s an expense to all your money containing flowed into emerging-market stocks throughout the last few weeks.

Exchange-traded funds dedicated to developed nations such as US lost near to $6 billion inside 5 days ending January 18, the 1st week of outflows in 12 weeks, data published by Bloomberg show. Electrical systems, emerging-market stock and bond ETFs have added cash for 14 consecutive weeks, a long streak of inflows each year.

Expectations for any pause in interest-rate tightening by the Federal Reserve and hopes that this US and China will reach a trade deal have boosted investors’ appetite for riskier assets. These securities, which are hammered during 2018’s stock selloff, now look cheap; and this — along with better growth prospects for emerging markets versus countries including the US — has investors diving into developing nations.

“If they are doing find the economic growth additionally, the earnings growth that’s expected, they’re going to show themselves to get awfully inexpensive,” said Mark Hackett, chief of investment research at Nationwide Funds Group, which manages $60 billion. “There’s loads of upside,” he said, adding that global markets tend to excel inside the later stages of any economic expansion.

Indeed, the MSCI Emerging Markets Index has increased more than 4% in January following a 17% plunge in 2009. Citigroup Inc. boosted its equity allocation in order to those markets to “slightly overweight” late not too long ago. And UBS Global Wealth Management, which can be overweight global equities, combined with emerging-nation stocks, citing attractive valuations.

But for funds dedicated to developed countries, that’s meant pain. The iShares MSCI ACWI ex US ETF — which has Japan, the U.K. and France because its largest exposures — has bled $642 million in January, on course to its worst month ever since the fund started higher than a decade ago. Its sibling, the $10.9 billion iShares MSCI ACWI ETF, has also lost cash, with investors yanking a record $345 million on January 14.

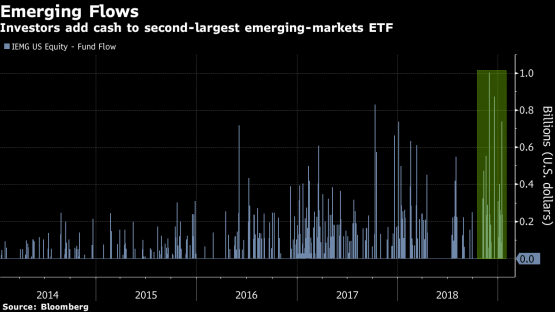

Meanwhile, assets inside the iShares Core MSCI Emerging Markets ETF — our planet’s second-largest emerging-markets strategy — have soared a great all-time high of $54 billion. The fund has absorbed close to $2.5 billion this month, fuelled by one investor making several massive trades a week ago.

? 2019 Bloomberg L.P